Eligible applicants

Newly set up enterprises or operating enterprises (SME’s or large enterprises), registered according to the Companies Law no. 31/1990

Eligible fields of activity

Initial investments are eligible in all fields of activity with the exception of those provided in the List of activity sectors which are not granted State” aid pursuant to this scheme, as mentioned in appendix no. 1 to Government Decison 807/2014

Eligibility of the project

The project must cumulatively fulfil the following criteria:

- they should be considered initial investments, as these are defined by art. 1 letter o) and p) in the Procedure on granting State aid provided in appendix no.2 to G.D. 807/2014;

- they should have a total value, exclusive of VAT, of at least Lei 44 million, or the equivalent of approximately EUR 10 million;

- they should prove their economic efficiency and viability during the period of implementation of the investment and 5 years after its completion, according to the business plan;

- they should reach the quantitative and qualitative indicators provided in appendix no. 2 to the Procedure on granting State in G.D. 807/2014;

- they should generate a quantifiable multiplier effect in the economy through driving other related investments and developing the local providers of products and services.

Eligible costs

Costs, exclusive of VAT, associated to the initial investment, corresponding to the performance or procurement, as applicable, of tangible and intangible assets as follows:

- new constructions of any kind – i.e. expenditure for the execution of constructions (the maximum value of the costs that can be considered eligible and correspond to the execution of constructions works cannot exceed Lei 1,650/sqm./spread area);

- expenditure related to the renting of constructions corresponding to the initial investment (the maximum eligible value of the rent cannot exceed Lei 22/sqm./month;

- expenditure related to the aquisition of new technical installations, machines and equipment (fixed assets with a minimum entry value of LEI 2,500, according to legal provisions in force and classified according to the Government Decision no. 2.139/2004 approving the ”Catalogue on the classification and normal terms of operation of fixed assets, as subsequently amended”);

- expenditure related to the acquisition of intangible assets (maximum 50% of the total eligible costs).

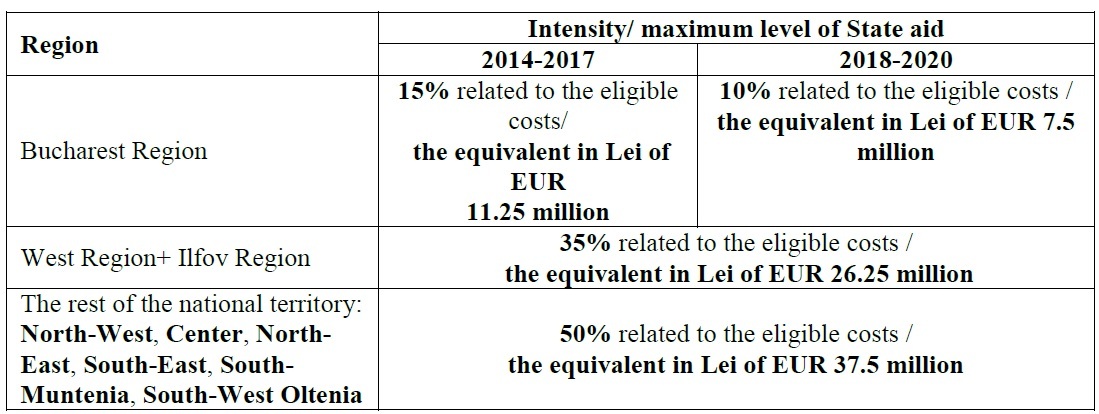

Maximum value and intensity of the state aid

Other relavant information

- The requested state aid cannot exceed the total value of contributions to regional development generated by the investment project;

- The obligation to substantiate the forecasted turnover. The enterprise must submit supporting documents such as (pre) contracts, agreements, letters of intent from potential clients;

- The incentive effect of the state aid granted must be proved.